Another refinery in California is set to close in April. It comes after one closed near Los Angeles in October.

Experts say this could lead to more money paid at the pumps.

Nevada has some of the highest fuel prices in the nation, above the national average. California is number one in the whole country.

Economic experts say part of the reason is high prices and taxes in California.

"Californians are driving less or at least buying less gasoline," said Elliott Parker, Economics Professor, University of Nevada, Reno. "There's more electric cars."

Phillips 66 closed its Los Angeles-area refinery in October. The Valero refinery in Benicia, California, in the Bay Area, will also close in April.

Those are two of the five big companies, including Chevron, PBF Energy, and Marathon, that own most of the big oil refineries in California. There are six smaller ones.

Parker says the lack of competition is increasing the prices as well.

"That's the worry is that this pie could become smaller and that would raise prices," he said.

Valero said it is closing due to costs and uncertainty imposed by California State regulations.

California is currently on a mission to get to zero carbon emissions by 2045.

During that stretch, the state wants to drop gas consumption by 94 percent.

However, less in-state production suggests more importing from other countries.

"The problem is when you try to import in fuel, your best option in California for the most part is to get it from Asia. Well, you're going to have to tank that across the Pacific, and it could take several weeks," said Matt McClain, Petroleum Analyst, GasBuddy.

McClain fears that having fewer refineries creates uncertainty if chaos strikes.

"The refineries that are left, if they have scheduled maintenance or an unexpected situation where it takes them offline, you don't really have a lot of wiggle room left," he said.

The Martinez Refining Company in California, which caught fire in February, is still working to reopen almost one full year later.

Experts are saying the expected price increase could range from pennies to a whole dollar by summer. This does not include the expected price jump that happens every year when switching over to summertime blends.

The Energy and Convenience Association of Nevada (ECAN) says they are meeting with state leaders to find both short-term and long-term solutions.

"We're really looking towards what other solutions could be and partnering with other states," said Miranda Hoover, State Executive, ECAN. "For the very first time again, could be Arizona, could be Texas, could be Wyoming."

Hoover says they are working with the Governor's Office to provide three recommendations, all catered to the short term.

Nevada Governor Joe Lombardo started a new Committee on Fuel Resiliency under the Homeland Security Commission to look at ways to address the problem.

Hoover said she will present the recommendations within 90 days of when the committee is officially launched.

Chase McNamara, Nevada Governor Joe Lombardo's Policy Advisor on Natural Resources, sent us a statement, in part, which said:

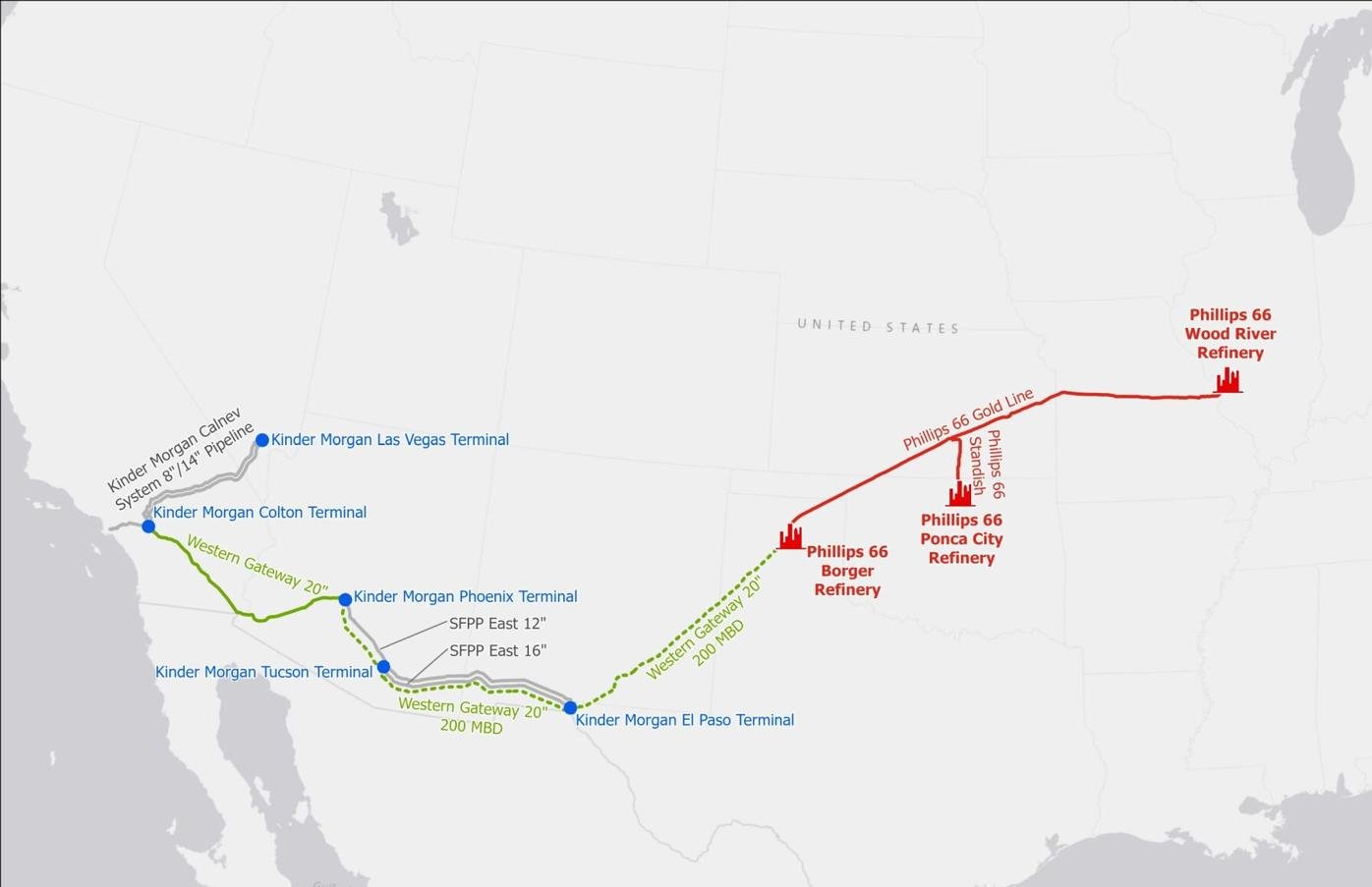

"We’re already seeing positive market signals. Investments and announcements by companies like HF Sinclair, along with infrastructure projects tied to Phillips 66 and the Kinder Morgan pipeline, show growing private sector interest in strengthening fuel logistics and resiliency in Nevada."

While the short term gets hashed out, there are some long-term plans in play.

The first couple involve building more pipelines. The Western Gateway Pipeline is looking to create a pipeline from St. Louis, Missouri, to California.

There is a direct pipeline from Los Angeles to Las Vegas that would benefit from this.

The other two pipelines are from Salt Lake City, Utah, to Las Vegas. The only one that goes straight to Reno comes from the Bay Area.

The other plan is looking to bring a whole new pipeline to the Biggest Little City.

HF Sinclair is looking to expand to western markets and create a pipeline straight from Salt Lake City to Reno.

However, all those plans would take years to develop.

A question that people may have is, why doesn't Nevada just make its own refinery? The state does not produce its own crude oil.

"We instead would have to truck or rail it into our state, then put it into the refinery, and then create the output," Hoover said. "So, that's issue number one. Issue number two is how much it's going to cost to build a refinery. We're talking upwards of $2 to $3 billion. That's with a B. And number three, the issue really ends up being the timeline."

Hoover says it would take at least five years to complete a refinery.