This week, the El Dorado County Elections Office accepted a South Lake Tahoe vacancy tax measure for the 2024 election. The grassroots group Locals For Affordable Housing collected 2,400 signatures last month, more than twice the required number to be on the ballot.

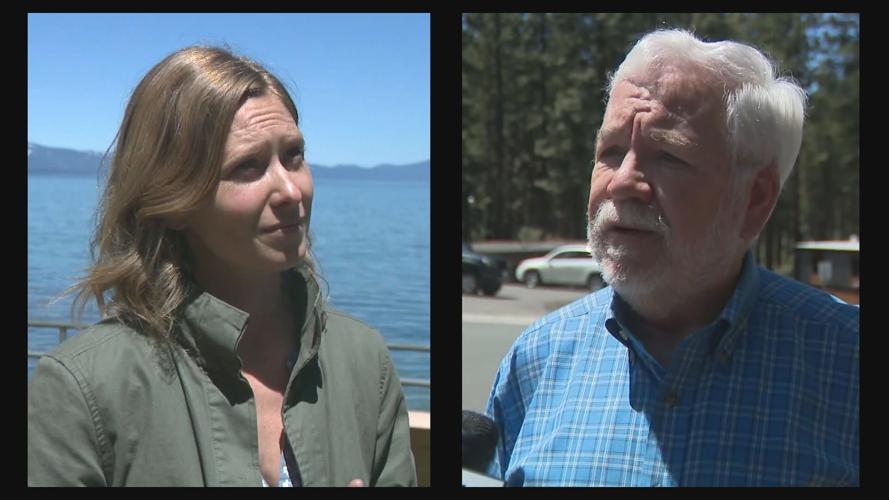

"Right now, nearly half of all homes in South Lake Tahoe are sitting vacant for most of the year, which is over 7,000 homes, while our workforce is struggling to find housing. We're struggling to keep teachers and professionals to continue running our tourist economy, so the vacancy tax is a tax on properties that sit vacant more than half of the year," explained Locals For Affordable Housing Co-Founder Amelia Richmond.

The South Lake Tahoe vacancy tax would charge vacant properties for more than half the year an annual fee of $3,000 the first year and $6,000 afterward. If a property were to be occupied for a year, it would revert to the earlier rate should it go empty again.

"It shifts the incentive: so right now, we've seen a 56% increase in vacancies since 2000, and the vacancies are outpacing the housing that we're building, so any solution to the housing crisis needs to shift the incentives; what a vacancy tax does is say you have the opportunity to either rent to a local part-time or contribute to our local economy," said Richmond.

Richmond tells us the revenue generated from the vacancy tax would go toward building more affordable housing, repairing roads, and improving public safety. She says right now, more than 50% of the workforce commutes into the basin for work, and the increase in traffic is a big polluter of the lake. The lack of workers living in the basin has also affected business.

In response to the South Lake Tahoe vacancy tax measure now officially on the ballot, an opposition group has formed to defeat it.

"It's a coalition of small businesses, taxpayers, residents, businesses of all sizes actually who believe this is the wrong way to solve what the proponents is a solution to affordable housing," said 'Stop South Lake Tahoe Vacancy Tax' Steve Teshara.

The Stop South Lake Tahoe Vacancy Tax group contends that the measure does not require the City to produce a single new unit of affordable housing.

"A lot of the money we believe if this passes will go toward setting up a tremendous bureaucracy needed to try and figure out whose house is vacant and how to enforce the measure, and also the legal defense of the measure, which it will be litigated," explained Teshara.

However, Locals for Affordable Housing say that argument is a misnomer.

"The funds for the vacancy tax can only be spent on housing, roads, and transit, three of our community's most critical issues. Right now, there is widespread support for building more affordable housing and solving the housing crisis; that is what the fund will be used for, in addition to solving the other problems our community has," explained Richmond.

The "Stop the Vacancy Tax" coalition also points out that many homeowners who will be taxed, should the measure pass, will not have the opportunity to vote on it because they are not registered voters in South Lake Tahoe.

"A lot of people who will be affected by the tax if it went into effect don't have a vote because they are second homeowners. They are not registered to vote in South Lake Tahoe, so it's taxation without representation.

The State of California has designated the City of South Lake Tahoe a pro-housing community. Right now, a Sugar Pine project within the village will deliver 248 deed-restricted affordable housing units.

"The City has several other projects in the works, but they are not going to solve all the problems. Other jurisdictions are going to solve a lot of this. The City shouldn't necessarily bear the entire affordable housing issue alone, so it just calls for a more thoughtful, complex solution," said Teshara.

"We want to be sure that people understand that the vacancy rate is increasing and that a solution needs to address that head-on. So, we want to be sure that people have the facts, and we'll be out there engaging in conversation in the community this summer," explained Richmond.